2024 Schedule A Form 1040 – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . The IRS says certain infertility treatments are tax deductible, but experts say the rules in this area are hazy, especially for LBGTQ+ couples. .

2024 Schedule A Form 1040

Source : www.investopedia.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

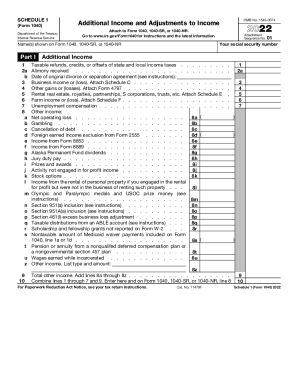

Source : www.incometaxgujarat.org1040SCHED1 Form 1040 Schedule 1 Additional Income and

Source : www.greatland.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.comMastering Schedule E: Tax Filing for Landlords Explained

Source : www.turbotenant.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

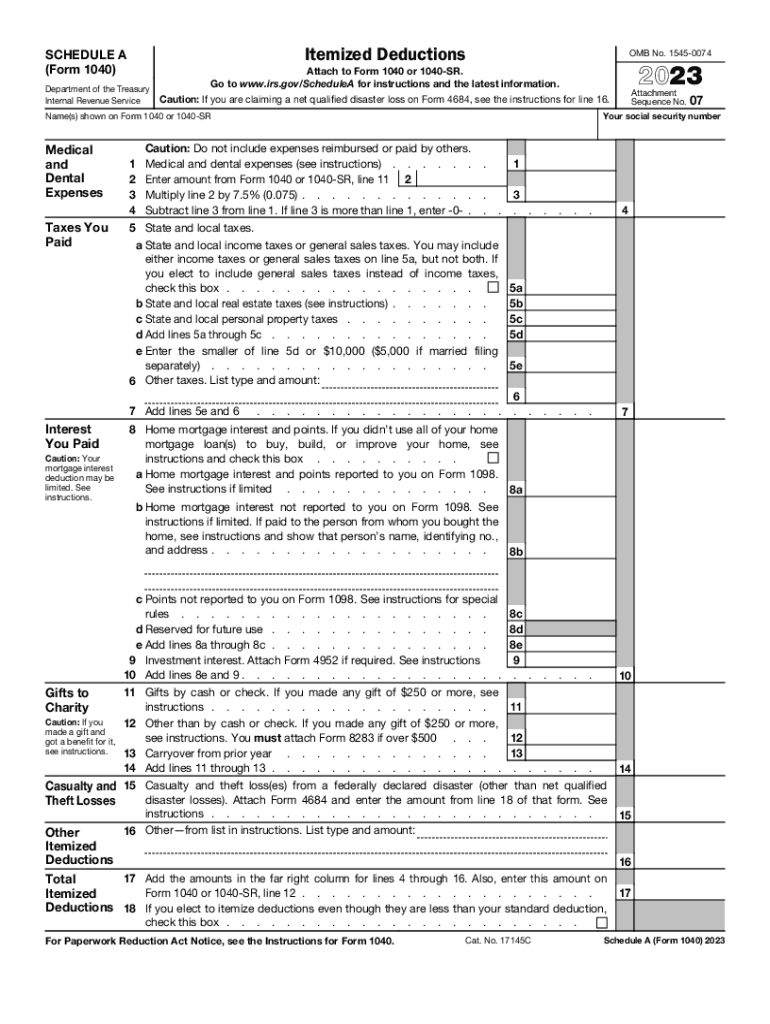

Source : finance.yahoo.com2023 Form IRS 1040 Schedule A Fill Online, Printable, Fillable

Source : irs-form-1040-schedule-a.pdffiller.comA1O04 Form 1040 Schedule A Itemized Deductions NelcoSolutions.com

Source : www.nelcosolutions.comIRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template

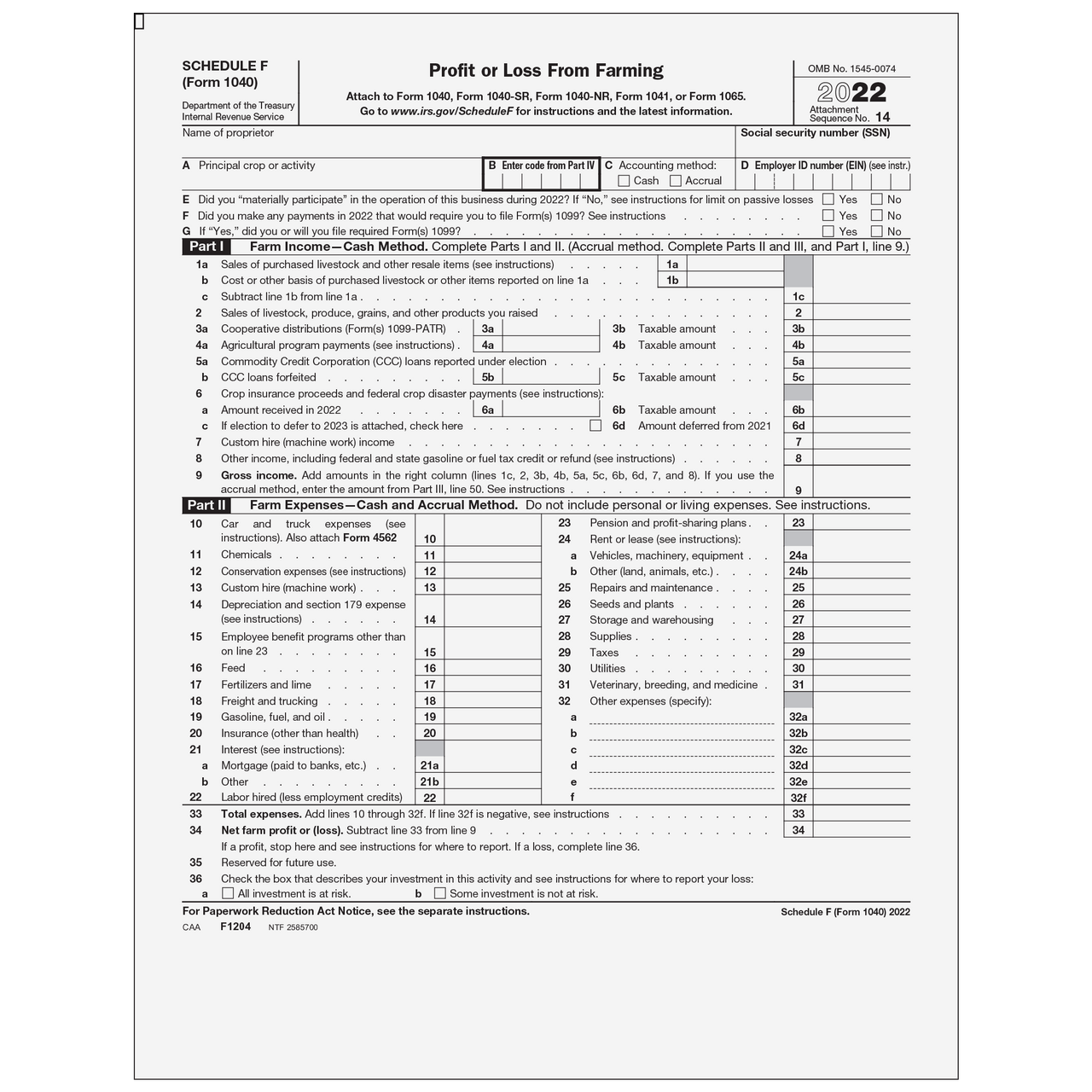

Source : www.uslegalforms.comF1204 Form 1040 Schedule F Profit or Loss from Farming (Page 1

Source : www.greatland.com2024 Schedule A Form 1040 All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: The money you win from placing bets on your favorite sports team is considered income, no matter how little. The IRS considers all winnings from gambling fully taxable, whether from a website, app, . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)